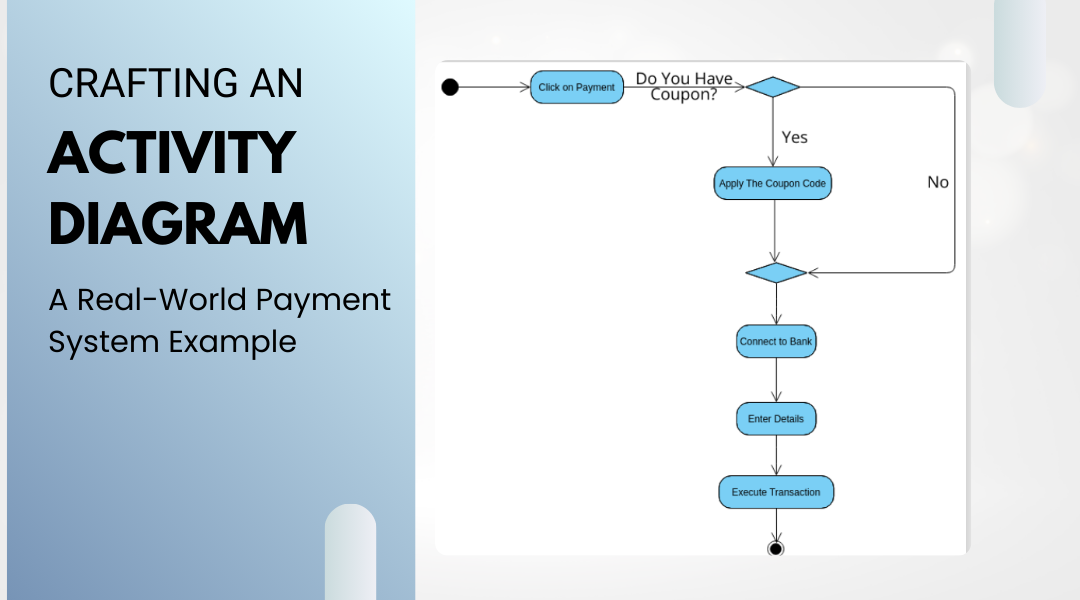

Activity diagrams are powerful tools for visualizing complex workflows, especially in systems where multiple stakeholders interact. Let’s break down how to design one for a payment processing system—a scenario that involves customers, payment gateways, banks, and merchants.

Understanding the Payment Workflow

Before jumping into the diagram, we need to map out the key players and their roles:

- Customer: Starts the transaction by entering and submitting payment details.

- Payment Gateway: Acts as the middleman, forwarding requests to the bank and relaying responses.

- Bank: Authorizes or declines transactions based on available funds or fraud checks.

- Merchant: Receives confirmation and fulfills the order.

Each step must flow logically, with clear handoffs between parties.

Step-by-Step: Building the Activity Diagram

1. Define Swimlanes for Each Actor

Swimlanes keep responsibilities organized. For our payment system, we’ll create four lanes:

- Customer

- Payment Gateway

- Bank

- Merchant

2. Plot the Key Actions

Now, we’ll assign actions to each swimlane in chronological order:

- Customer Lane

- “Enter card details” → “Submit payment”

- Payment Gateway Lane

- “Validate payment request” → “Forward to bank” → “Receive authorization status”

- Bank Lane

- “Check account balance” → “Approve/decline transaction” → “Notify payment gateway”

- Merchant Lane

- “Receive payment confirmation” → “Process and ship order”

3. Connect the Dots with Control Flows

Arrows show the sequence:

- The customer submits payment → the gateway validates and forwards it → the bank checks funds → sends approval/denial back → the gateway updates the merchant.

4. Highlight Data Movement (Optional)

If needed, dashed arrows can represent data flow, like:

- Payment details moving from customer → gateway → bank.

- Authorization status flowing back to the merchant.

5. Refine for Clarity

- Avoid overcrowding: If the process has too many steps, consider splitting it into sub-diagrams.

- Label clearly: Ambiguous terms like “Process” can confuse—be specific (e.g., “Verify card security”).

- Check interactions: Ensure no swimlane operates in isolation—every action should trigger or depend on another.

Common Mistakes to Avoid

- Mismatched swimlanes: Don’t let actions spill into the wrong actor’s lane.

- Overly linear flows: Real-world systems have alternate paths (e.g., “Payment failed → notify customer”).

- Ignoring exceptions: What if the bank’s system is down? Include error-handling where relevant.

Final Thoughts

A well-structured activity diagram turns abstract processes into something tangible. For payment systems, clarity is critical—every actor must know their role, and every transition should make logical sense. Start simple, refine as needed, and always test the diagram with stakeholders to ensure accuracy.

By following this approach, you’ll create diagrams that not only map workflows but also highlight potential bottlenecks or inefficiencies—essential for optimizing real-world systems.